Vice president of finance

Scott Hoover

Scott Hoover and his team will oversee every phase of financing including: acquisition, debt, equity, mezzanine and C-P.A.C.E.

Incorporated in 2017, HFE provides a complete capital solution for commercial and hospitality developers seeking ground-up and mid-construction financing. HFI is committed to a complete solution integrated with C-P.A.C.E financing to maximize the sponsor/developer’s leverage into the capital stack.

Originating in Mortgage Loans, Scott is a turndown specialist. He repackages the file. The lender needs to understand why the financing makes sense, and that is where he adds value to the clients he works with.

Private and hard money / construction loans / hotels / equity participation opportunities. Scott’s an outside of the box thinker – not your regular commercial lender.

Financing

We understand the changing needs of our public and privately held clients in the capital markets. We will not only engineer your system but also work with your CFO and treasury department to finance the build-out.

$1 Billion Available for Commercial Solar and Renewable Energy Projects

As one of the premier providers of solar panels, energy-saving and energy-creating products in the U.S., Modern Thermal Design has attracted some of the top lenders in the world to finance our diverse product line, with over $1 Billion available for our commercial, industrial, institutional, and government clients.

Financing Available for All of Our Renewable and Energy Saving Products

Capital leasing is our most popular funding vehicle. It is straightforward, easy to understand, and the seamless end-of-term ownership transition is completed with the exchange of just one dollar ($1.00).

Leasing Example for Large Systems

Lease Terms – Up to 84 months.

Lease Terms – Up to 84 months.

Lease Structure – Zero end-of-term risk with a one-dollar ($1.00) buyout.

Tax Credits – 100% pass through of tax credits, rebates and incentives.

Finance Limits – Up To $50 Million per project.

Zero Down – 100% funded including soft costs.

Flexible Lease Schedules – Lessee selects lease go-live date.

Qualifying – Traditional and generally accepted EBITDA debt service calculation of 1.25:1 for the prior 3 years.

Security – The lender has an interest in the equipment only.

Ownership – The client shall be the owner of the property for legal and tax purposes.

For an operation concerned about cash flow, we recommend an operating lease. These can be structured to meet current cash flow needs with a balloon at the end of the term. The fair market value of the system will be established.

Lease Terms – Up to 84 Month Terms

Lease Terms – Up to 84 Month Terms

Lease Structure– Traditionally a FMV buyout at the end of term

Tax Credits – Tac Credit Goes to The Lender

Tax Treatment– Considered a Rental All Payments are Deductible

Finance Limits – Up To $50 Million Per Project

Zero Down – 100% Funding Including Soft Costs

Flexible Lease Schedules –Lessee Selects Lease Go Live Date

Qualifying – Traditional and generally accepted EBITDA debt service calculation of 1.25:1 over the prior 3 years.

Security – The lender has an interest in the equipment only

Ownership – The lender or underwriter shall be the owner of the Property for legal and income tax purposes.

A PPA or Purchase Power Agreement is a great way for any established business to manage its increasing power costs by using a PPA. Basically, a long-term lender will pay for all of the upfront costs to build and install your solar array. Then sell your power at a specified price and then resell any remaining at higher valuations, their return. Although there are many restrictions, the contracts are complex and only a few potential sites will qualify there are still great opportunities.

The benefits of a PPA include the following:

CASF FLOW POSITIVE FROM DAY 1 – A PPA will pay for 100% of the cost to install the project including parts, labor, equipment, and freight. The power available is most times less than the going retail rate of electricity. This usually makes any well-designed PPA cash flow positive right from the start.

OWNED AND OPERATED BY A THIRD PARTY – Under the terms of a PPA, a third party takes responsibility for installing the system, taking ownership, and maintaining the system as needed. This relationship allows the customer to completely bypass any admin responsibilities of the risk associated with the equipment ownership.

OFF-BALANCE SHEET – The PPA by design is off the balance sheet of most companies. Thus making it an ideal solution to manage costs without incurring the traditionally associated expenses.

CONSISTENT AND STEADY ENERGY PRICES – PPAs will secure or lock in the energy prices agreed upon which protect the customer from the onslaught of price increases being realized so aggressively all over the country.

Lease Terms – Up to 30 years

Lease Structure– Property Tax Assessment

Tax Credits –Potential Tax Credits

Finance Limits – Up To $200 Million Per Project

Zero Down – 100% Funding Including Soft Costs

Flexible Lease Schedules – Long-Term Payment Stream

Qualifying – Easy Qualification

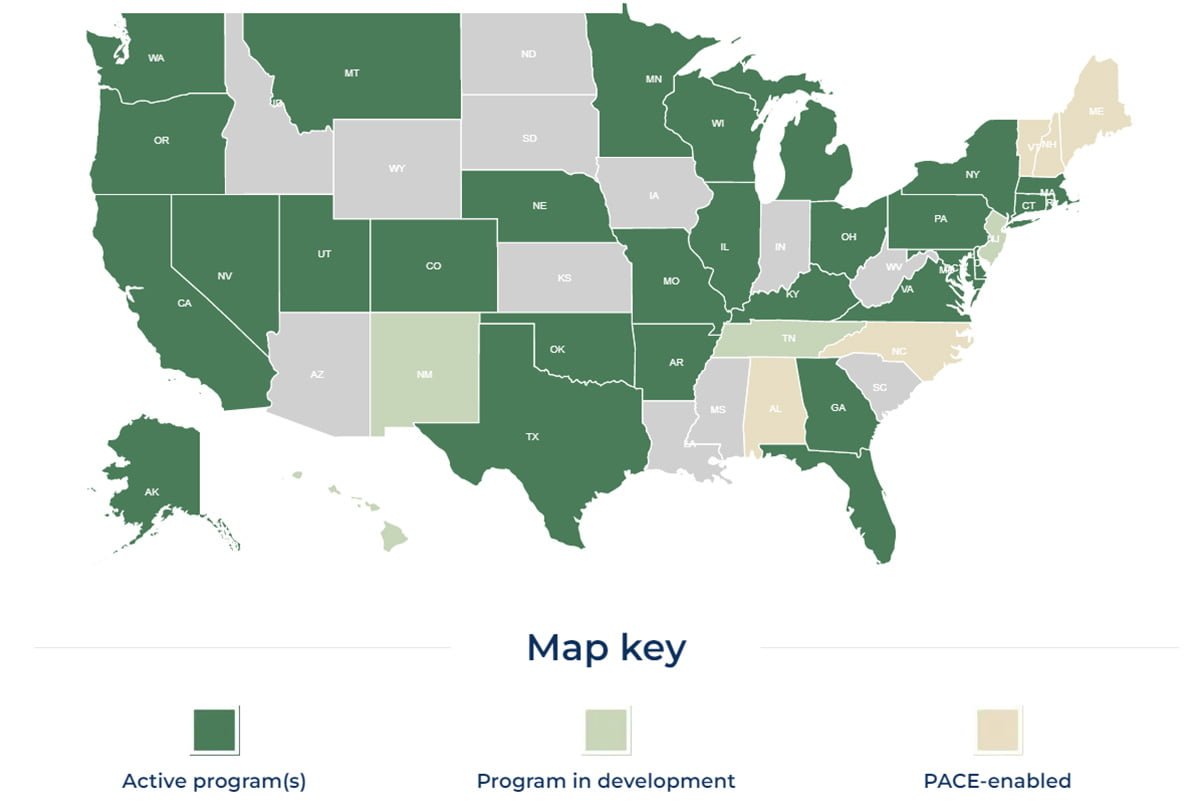

What is C-PACE? C-PACE stands for “Commercial Property Assessed Clean Energy”. C-PACE is a program sponsored by each state providing a mechanism that allows developers, building owners, and landlords the ability to access capital to install, upgrade and renovate their property with renewable energy or energy-saving upgrades.

How does C-PACE Work? C-PACE provides long-term, easily accessed, and off-balance sheet financing for worthwhile energy-realted projects. Most commercial facilities will qualify for C-PACE financing as long as the technical upgrades actually qualify due to energy creation of conservation.

How are Funds Repaid – As these funds are not considered loans as much as they are property enhancements. The repayment process is incorporated into the business’s annual property tax assessment for a period of 25-30 years. The assessment is transferrable to any new owner of that facility and remains an obligation until repaid.

While facilitating sustainability efforts, the program reduces property owners’ annual costs and provides dramatically better-than-market financing

As most of our clients are well-managed public and privately held companies. Many will opt to use available cash, draw down on a line of credit, or in some cases where the installation is very large may issue a debt instrument to pay for the energy upgrade or solar installation.

What Is Debt Financing? Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and/or institutional investors. In return for lending the money, the individuals or institutions become creditors and receive a promise that the principal and interest on the debt will be repaid.

The other way to raise capital in debt markets is to issue shares of stock in a public offering; this is called equity financing.

We encourage all of our clients to be wise with the decision of funding in an economic environment where there are numerous uncertainties and potential economic hard times ahead. Most CFO’s we meet with regularly are recommending a course of cash preservation in all the subsidiaries and the use of lease funds to pay for the energy upgrades or conc=version of a plant to a power station.

C-PACE Approved States

Alaska (AK)

C-PACE funding is available for any renewable energy project or commercial solar systems in Anchorage, Juno, Fairbanks, and all of the state of Alaska. C-PACE funds are easy to qualify for, with great rates and long-term financing of 30 years.

California (CA)

We are pleased to provide C-PACE funding for the entire State of California and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Colorado (CO)

C-PACE stands for Commercial Property-Assessed Clean Energy, this financing is perfect for renewable energy or commercial solar in Denver, Ft. Collins, Aspen, Colorado Springs, Boulder, Grand Junction, and the entire state of Colorado

Connecticut (CT)

C-PACE funding in Connecticut includes Hartford, New Haven, Stamford, Bridgeport, and 20 other cities covering the whole state. This long-term financing is perfect for commercial buildings for small and large renewable energy projects.

Delaware (DE)

Renewable energy and energy conservation upgrades in Delaware are going up rapidly. One of the most sought-after financing mechanisms is C-PACE which covers the entire state, including Wilmington, Dover, Newark, New Castle, and many more.

Florida (FL)

The sunshine state is appropriately named as it is a hotbed for any solar-related project. Property owners and commercial building developers are finding a unique funding option through the C-PACE program sponsored by the state of Florida and available to all.

Hawaii (HI)

Honolulu, Hilo, Kona, Lihue, and every city on the island of Hawaii are approved to use C-PACE funds to remodel their commercial property with solar or any other energy-saving upgrade HVAC, Heating, Boilers, Energy Management Systems, and more.

Illinois (IL)

Rooftops throughout Chicago, Peoria, Springfield, and all Illinois cities are now showcasing thousands of brand-new solar panels generating power and clean energy for the town. Many of these projects were funded using the generous C-PACE funds allocated to help with energy upgrades in Illinois.

Kentucky (KY)

Solar, Turbines, High-Efficiency Boilers, Energy saving HVAC, and any commercial upgrade that meets the state’s expectations are available to be paid for by C-PACE funds which are available, for long-term financing, and are easy to qualify for.

Massachusetts (MA)

With so many historical landmarks in Boston, Salem, Cambridge, Worcester, Plymouth, and more, the need to upgrade is vital. If the owner or developer elects to use qualified energy-saving products, the door to C-PACE funding opens to finance 100% of the project.

Maryland (MD)

Financing a commercial remodel project in Baltimore, a new development in Annapolis, or expanded housing in Ocean City is always a concern. Not anymore with state-sponsored C-PACE funding, which allows for 100% funding, long terms, great rates, and easy qualifying.

Maine (ME)

We are pleased to provide C-PACE funding for the entire State of Maine, including Portland, Augusta, Bar Harbor, Bangor, and the entire state. C-PACE financing is changing the feasibility of projects all across the state.

Michigan (MI)

C-PACE funding in Michigan is changing how builders and developers think about projects. From Detroit to Lansing to Grand Rapids, discussions are taking place regarding C-PACE and its impact on the Michigan economy.

Minnesota (MN)

Developers and builders are all going crazy at the prospects of C-Pace funding in their state for their energy-sensitive projects. C-PACE in Minnesota will help finance solar projects, smart HVAC, and a host of others that are approved and designed to reduce the carbon footprint and save money on the power bill.

Missouri (MO)

Missouri is the home of St. Louis, Kansas City, Jefferson City, and a host of others on the cutting edge of technology and using C-PACE funds to upgrade, remodel and install high-efficiency new appliances.

Montanna (MT)

C-PACE funding for Helena, Bozeman, Billings, and the entire state, with long-term, inexpensive capital tied to your property tax and annual payment.

Nebraska (NE)

We are pleased to provide C-PACE funding for the entire State of Nebraska and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

New Jersey (NJ)

We are pleased to provide C-PACE funding for the entire State of New Jersey and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Nevada (NV)

We are pleased to provide C-PACE funding for the entire State of Nevada and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

New York (NY)

We are pleased to provide C-PACE funding for the entire State of New York and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Ohio (OH)

We are pleased to provide C-PACE funding for the entire State of Ohio and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Oklahoma (OK)

We are pleased to provide C-PACE funding for the entire State of Oklahoma and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Oregon (OR)

We are pleased to provide C-PACE funding for the entire State of Oregon and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates power qualifies.

Rhode Island (RI)

We are pleased to provide C-PACE funding for the entire State of Rhode Island and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Tennessee (TN)

We are pleased to provide C-PACE funding for the entire State of Tennessee and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Texas (TX)

We are pleased to provide C-PACE funding for the entire State of Texas and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Utah (UT)

We are pleased to provide C-PACE funding for the entire State of Utah and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Virginia (VA)

We are pleased to provide C-PACE funding for the entire State of Virginia and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

West Virginia (WV)

We are pleased to provide C-PACE funding for the entire State of West Virginia and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Washington (WA)

We are pleased to provide C-PACE funding for the state of Washington and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Wisconsin (WI)

We are pleased to provide C-PACE funding for the entire State of Wisconsin and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies

Washington (DC)

We are pleased to provide C-PACE funding for Washington DC and its cities and counties. Any project that upgrades a commercial property to be more energy efficient or creates its power qualifies